Best Blogs of the Week #242

Four interesting posts this week highlighted by a game theory discussion via William Blair.

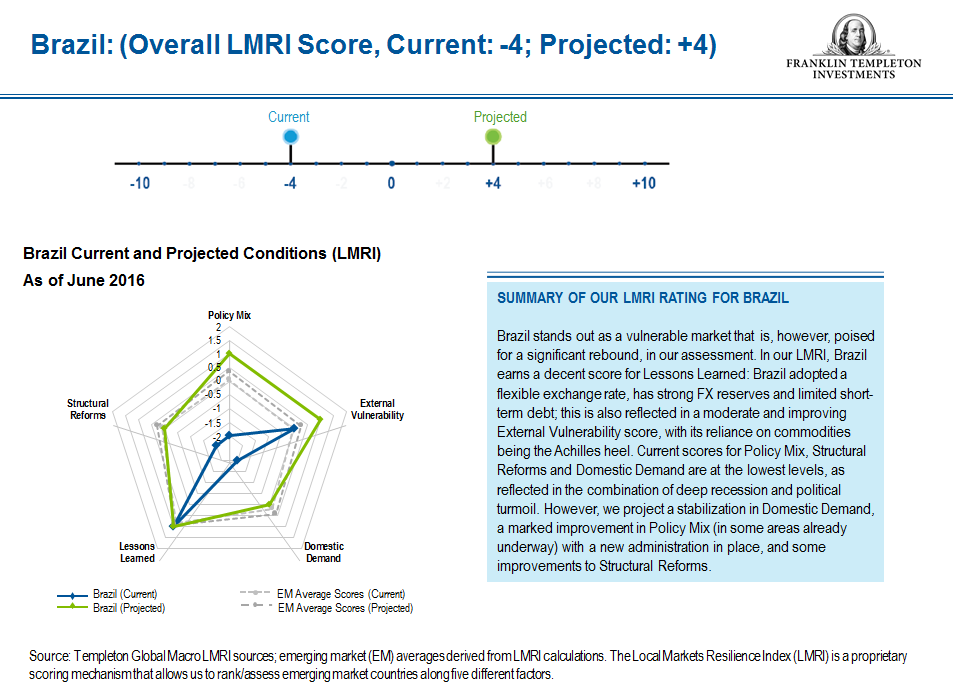

Franklin Templeton – Spotlight on Brazil– Once political stability is restored, tackling much needed structural reforms should be a priority, in our view.

Van Eck – Quality Can Be Rewarding in Emerging Markets Bonds – Overall, investors who maintained exposure to investment grade emerging markets sovereign bonds, with an allocation to BB-rated bonds or 20%, would have earned 7.55% over the past ten years versus 7.83% on the broader emerging markets sovereign index, with lower volatility and higher risk-adjusted returns as measured by the Sharpe ratio.

Vanguard – Do ETFs make the value of the underlying securities more expensive?– … strong or weak flows into certain ETFs or categories do not inflate or deflate prices any more than mutual fund flows or the collective purchases of individual investors into stocks like Apple or Facebook. Rather, ETFs reflect the valuation of the underlying securities they are composed of, which is driven by the collective wisdom of all market participants.

William Blair – Dimensions of Influence Drive Game Theory Analysis – What does this have to do with investing? Game theory provides a way for us to better organize and process the vast amount of information that affects global economies and markets.