Digital Lesson from Robo-Advisors

Throughout 2014, we read much about the emerging robo-advisor industry and how it may be the disruptive technology to ‘revolutionize’ the traditional financial advice/guidance industry. Personally, I think revolution is probably a generation away, if at all. Regardless of the potential disruption, asset managers can improve their digital execution by learning from robo-advisors. To my eye, the best example is in tax-loss harvesting. Tax loss harvesting is a popular topic with financial advisors and many asset managers develop related FA support materials. Look at these blog posts from Russell, Vanguard, and BlackRock (best of the three).

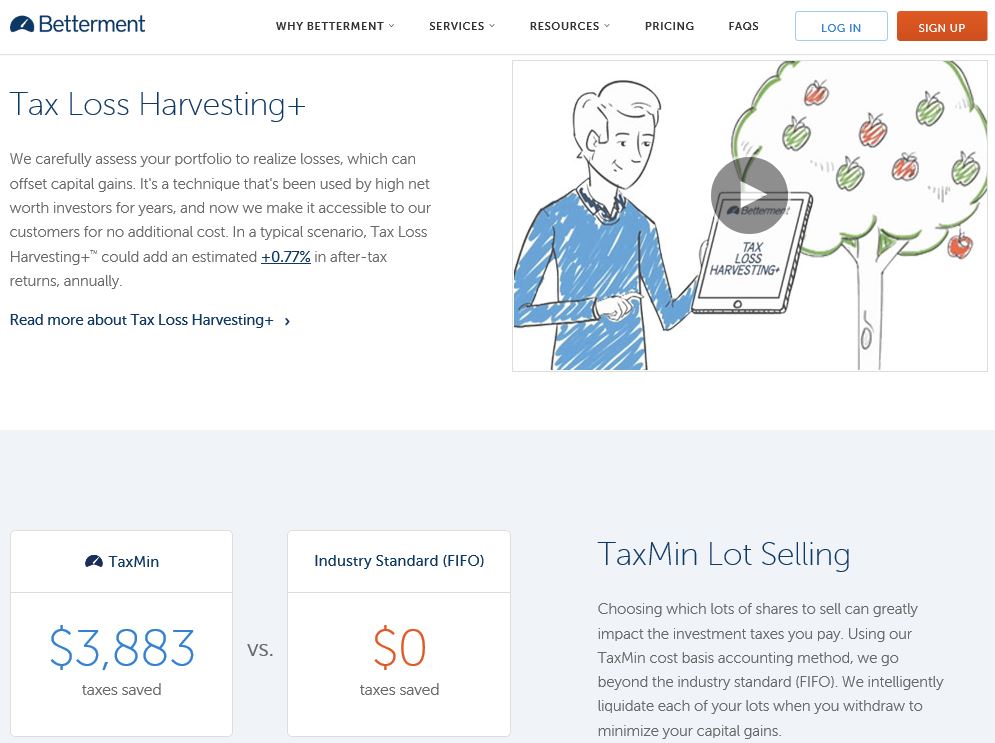

Yet typical materials and blog posts rely on the user reading a lengthy, uninterrupted piece to better understand tax-loss harvesting. This Betterment implementation surpasses those by mingling text, video, graphics, and multiple sub-sections. Simply, Betterment presents a relatively dry and important topic in an engaging manner that asset managers could benefit from studying.