Proprietary Magazines Coming to Asset Management?

Content marketing has come to the real estate industry. Douglas Elliman, the 4th-largest real estate firm in the US, launched a lifestyle magazine (via Wall Street Journal) that does not sell, market, or promote their current properties. Two years ago, we noted the online retailer, Net-a-Porter, and their magazine, Porter, in a client engagement with a top-10 asset manager. The magazine concept is an interesting technique for an asset manager looking to organize disparate in-house content sources. Leafing through Porter, you see the easy connection between retailer and magazine. Interspersed within the articles are clothes and accessories sold on the Web site. Looking through Elliman, there are no articles about new residential towers in Manhattan or Miami, rather Q&As with Ted Allen and Katie Lee.

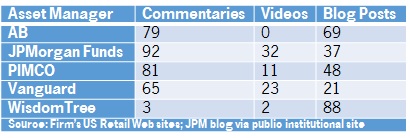

In our industry we have a DC-focused magazine: Journey from JPMorgan. Journey follows thePorter model covering topics like Social Security’s future, diversification in a DC plan, and rising health care costs.

Will we see more magazines? If done well (good articles, quality paper stock, stunning photos and imagery), I see the appeal and I can imagine a magazine has a higher chance of finding its way into an FAs briefcase (or app on her tablet) than a PDF. And that’s a significant step towards building appeal with advisors.