Apps all the talk (in this post too). Sites do the work.

During a client’s all-day digital planning off-site, the conversation turned towards building an app. Should 2015 be the year we release a tablet/phone app? Someone referenced a recent conversation with an external wholesaler. He recounted the wholesaler saying, “What are you guys [in digital marketing] doing? I was in a FAs office the other day. During our conversation the FA asked if we had an app and then proceeded to show me Putnam’s Fund Visualizer. We need something too.”

Count one for keeping up the Joneses. There’s some validity to managing perception and a slick, highly usable app may impact perception. Also, building an app is a tangible “win” that Digital Marketing can point to. Broadly, does building an app make sense for retail-focused asset managers? Volume can’t drive the decision. With approximately 250,000 US financial advisors and 22% (or less) using tablets, the entire target market is less than 50,000 people. If we estimate that 10% of those FAs download asset manager apps, then we have 5,000 as the top-line. Not very many.

What if an app can support a limited set of FAs extremely well, making those FAs more loyal and inclined to use multiple funds? Perhaps it is still worthwhile. Going down this road, the key questions we’d recommend discussing include:

- Apps need promotion to build usage. Are we well-equipped to promote an app?

- Since apps need to be continually fresh, are we capable of maintaining freshness?

- What’s the shelf life for our app idea? Are we comfortable with a short shelf life? Oppenheimer had a high-quality app to support the Globalize Your Thinking campaign. As they phased out the campaign, the app became unnecessary.

- Does our app idea have some clear benefits over the traditional Web site? (A few) FAs have told us that they like the PIMCO app because it downloads content, enabling reading thought leadership without connectivity.

- Does the app support Sales without being disruptive or preemptive?

- How will we measure success?

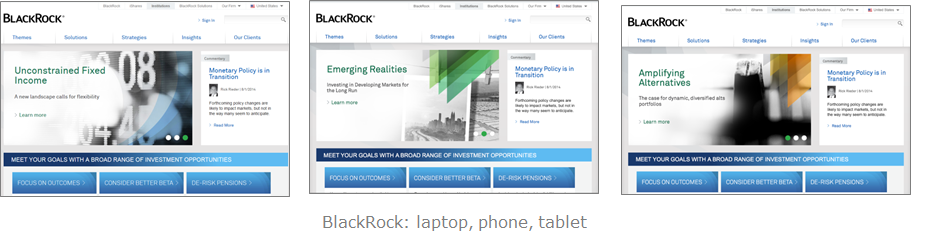

Before discussing any of these questions, I recommend answering a more obvious, staid question: does our site look excellent on a tablet or mobile phone? Mobile browser usage is unequivocally higher than app usage, making the site more vital to clients and prospects alike. Going into 2015, phones are growing in size and resolution (have you held an iPhone 6 plus yet?), bandwidth is increasing, and (most importantly) user expectations for mobile experiences on Web sites are higher than ever. Simply put, the site has to be complete, fast, and crisp on a phone first. Apps are secondary.