Best Blogs of the Week

Hope everyone enjoyed a good long weekend. Two very different posts to review here.

Hope everyone enjoyed a good long weekend. Two very different posts to review here.

New ETFs from firms with no ETF history. Prestigious long-only managers launching alternatives. Massive non-US banks entering the domestic asset management landscape. All seem to be occurring at a more frenetic pace than ever.

We’ve been supporting clients in these and similar situations. A client from last year mentioned Killian Branding during an engagement. And their post recently on customer service is very poignant. More broadly than this post, our advice for clients in these situations is to carefully study the providers with significant market share. The burden of the new entrant is to provide a new reason to do business with them. Paradoxically, it’s a burden and a great opportunity.

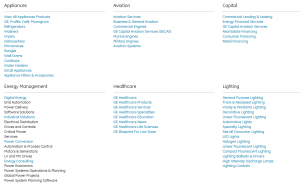

You’re a mutual fund manufacturer with 50, 60, maybe even 100 mutual funds. On your Web site, the initial idea was to present them alphabetically. Perhaps, a few years later you broke them into asset classes, then alphabetic, but now you’re not sure at all what to present. Where’s a good place for ideas? Maybe look outside the industry for innovation?

I did a quick review of the four largest companies (I started by market cap, removed non-US companies and oil/gas companies).

Anyhow, there is a “Products” tab that presents a “mega-menu” organized by asset class (or product class here) first and then by business customer segment.

Anyhow, there is a “Products” tab that presents a “mega-menu” organized by asset class (or product class here) first and then by business customer segment.

Two quick observations:

Not a large swath of great posts this week.

This week’s best posts are plastered with great charts and tables. FAs (like all us) gravitate towards them to decide whether we should read this blog post. Additionally FAs can reference these graphs/charts easily in conversations.