Mid-December usually yields numerous year-in-review and prognostication newsletters, emails and blog posts. Often they are valuable for FAs as they plan and deliver a year-end message to clients and prospective clients. There were two strong posts that share opinions on 2012 and what may occur.

- BlackRock – No surprise that this post focuses on ETFs. As the ETF vehicle becomes more popular with advisors, then dispelling myths become more crucial.

- Russell – A succinct review from another great Russell survey shares some helpful opinions and thoughts on what may occur in 2012.

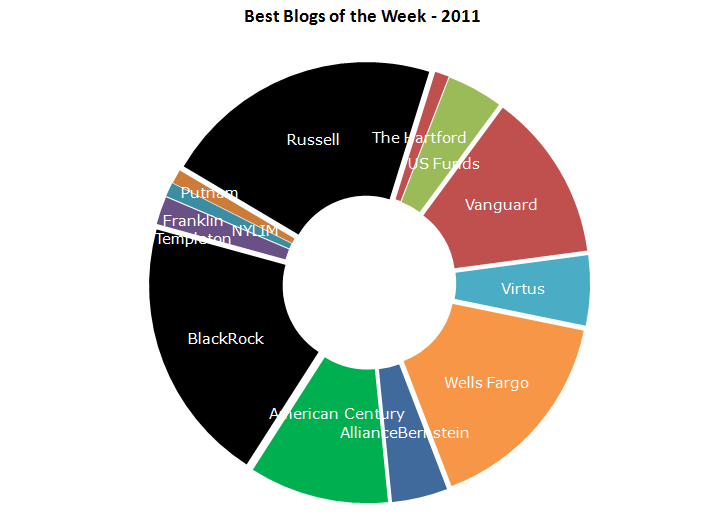

Happy New Year. This is the final BEST of BLOGS for 2011. If you’ve enjoyed, agreed, disagreed, disliked them, please send an email and let us know.

On December 31st, we’ll crown one blog post as the best blog of the year. After that, we’ll resume the review on January 9th.