Marketing Alternatives: The Importance of Education (Part II)

Second in a series of posts about marketing alternative investment vehicles to financial advisors. Check out the first post here.

Last week I made the case for why educating advisors needs to be a focus for any investment manager attempting to market alternative investments.

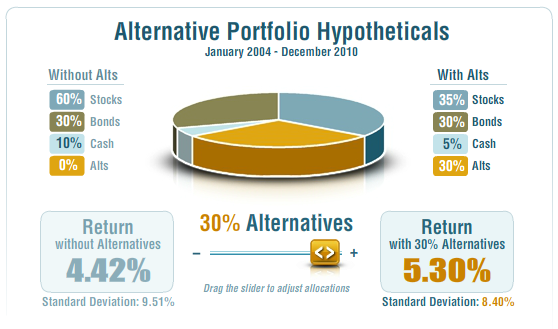

Today I’ll make the case that I was wrong. And I’ll start, again, with a graphic:

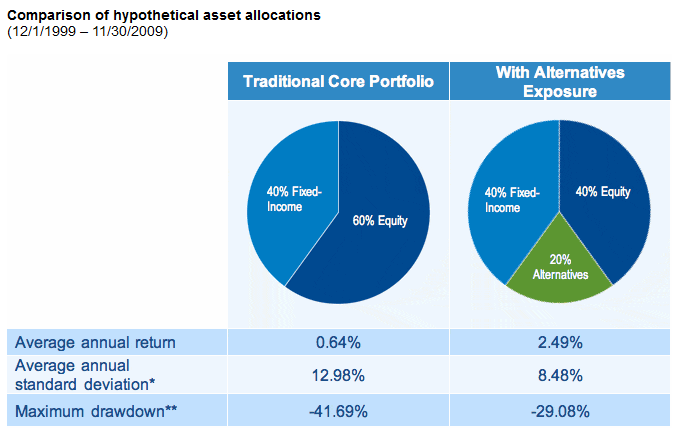

The above is from Rydex | SGI’s getalts.com, and it communicates a nearly-identical message to the one from Natixis I referenced last week. Namely, that alternatives can enhance portfolio returns while reducing volatility.

This story sheds light on a major reason not to expend a lot of effort on educating advisors about alternatives: everyone is broadcasting a similar message. While often viewed as table stakes in messaging alternatives, the fact is that it’s very tough to stand out when it comes to the basic “Why Alternatives?” conversation.

Besides sameness, two other reasons support focusing efforts away from education:

- Distribution partners will get more picky. Yes, distributors need help educating their FAs, but they’re also seeing an influx of similar materials. We’ve had a few managers tell us they’ve gotten lukewarm responses to educational offerings. I think that’s in part because there are many already out there. Not every firm can be a go-to resource for informing advisors.

- Usage of alternatives is concentrated. This is the exact same statement I used to justify including education as a core marketing component – because so many FAs are dabblers. The converse, and also valid, view holds that there’s no point in focusing on the dabblers. Instead, flows to alternatives will come primarily from the 10-20% of FAs who are heavy users, at least for a while. And they are the ones that don’t need the education.

Given that most firms have limited marketing resources and a finite slice of advisors’ attention, it’s perfectly justifiable to focus on the proprietary aspects (e.g., firm, strategy specifics) of the alternative story at the expense of educational content.

Ultimately the importance of education when it comes to marketing alternative vehicles presents a tricky situation for firms. In the next post, I’ll address the mixed messages being provided on how alternatives should be used in clients’ portfolios.