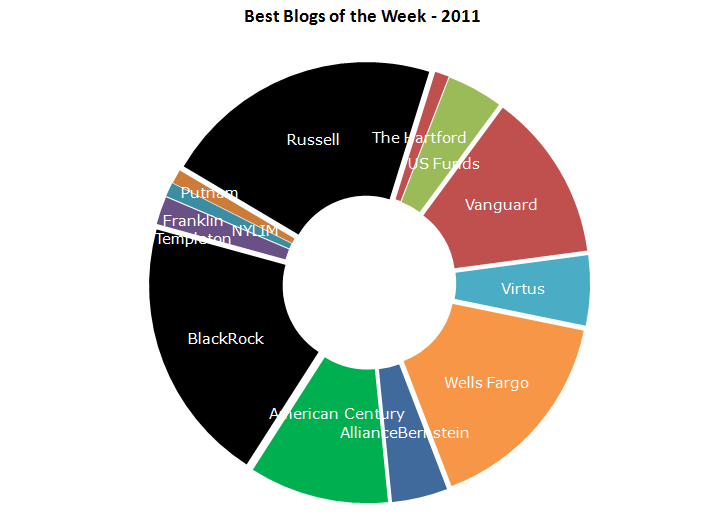

Best Blogs of the Week

Four interesting blogs – 2 related to the ECB’s unchanged rates. I’m impressed with many firms that are using the blog to establish thought leadership related to current events and do it very quickly. Congrats to Pioneer – another firm entering the “best” mix for the first time.

- BlackRock – The coverage of New Hampshire and South Carolina is intense. This post covers another election, occurring this weekend, that is critical for global investors.

- Columbia – This post shares how to consider long-term investments related to the Panama Canal upgrade; really interesting and pretty different from the standard posts.

- Pioneer – Bringing an interesting relation between emerging markets and rates in Europe, this post shares an interesting position along with a link to a more detailed report.

- Wells Fargo – Dr. Jacobsen’s post immediately addresses ECB’s actions and the potential impacts.