Posted by Mike McLaughlin

on Nov 03, 2011,

in

Thoughts

, tagged with

eBusiness,

mobile,

Web sites

Last week we presented at the MFEA Council meetings in Chicago. The topic: mobile strategies.

We covered a lot of ground in our presentation – device and mobile Web usage trends, sites vs. apps, client-facing tools, mobile efforts to support field personnel – which we’re more than happy to share if you drop us a line.

The subsequent roundtable conversation covered a lot of ground as well. To my surprise, though, one topic got very little airtime as firms shared strategies with one another: mobile Web sites.

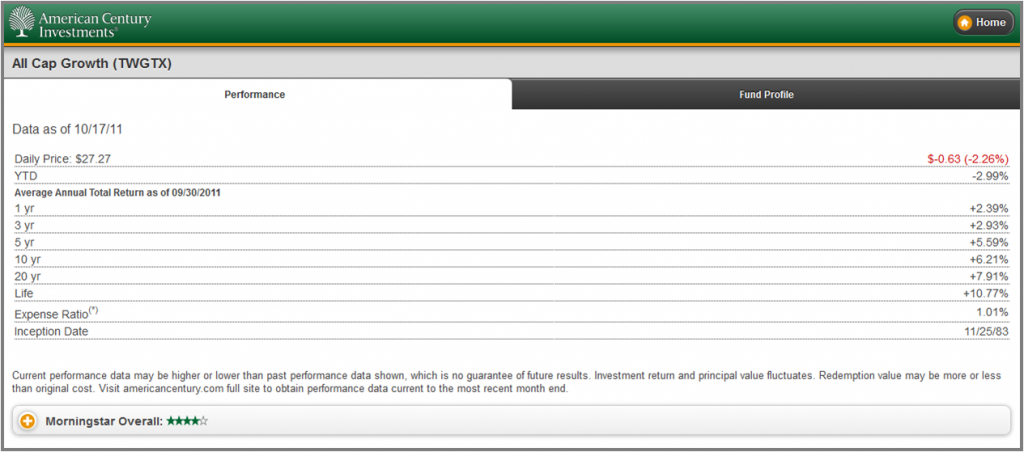

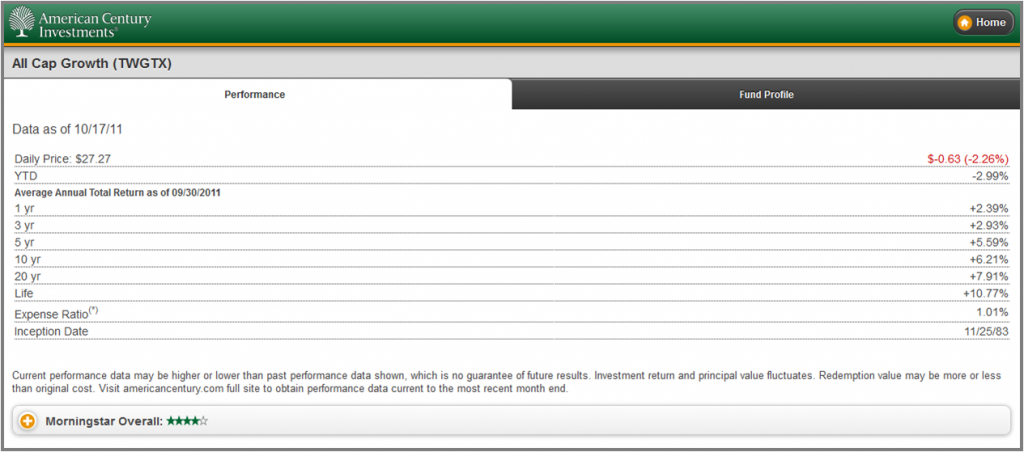

A fund profile on American Century's mobile site.

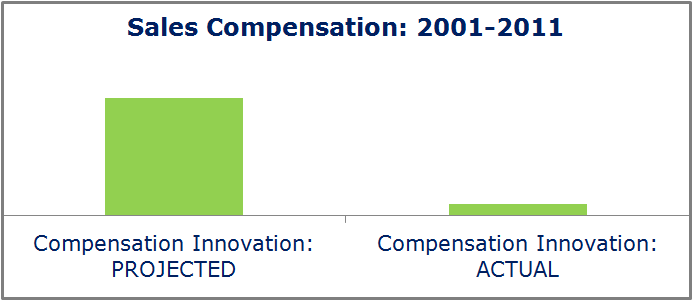

Back in 2010, Dalbar noted that 24% of asset managers have a mobile Web site. Current estimates lie in the 25-35% range, so there hasn’t been a big move. Why the lack of interest? I see three themes:

- Mobile Sites are Boring: iPads and apps are sexy. A mobile site, on the other hand is purposefully designed to be a simplified, streamlined experience (single column, limited graphics/multimedia) that delivers the basics (product info, commentary, etc.). There’s not as much room to innovate, so firms see the sites as a snoozer.

- There are Bigger Fish to Fry: Right now mobile-generated Web usage comprises 7% of all Web traffic. Some firms see that as a big number, some see it as small (especially intermediary/institutional managers). So, when it comes to budgeting, a mobile-optimized site simply misses the cut.

- There’s Hope for Convergence: 6,500 different mobile devices exist. The Android, Apple, and BlackBerry operating systems all maintain significant market share (20%+). The marketplace is fragmented. But as more people get smartphones and tablets with ever-faster connections, some firms hope that, eventually, most bases will be covered with a single site.

But each of these lines of thinking is flawed. While less sexy than apps, mobile sites currently have the greater potential to reach clients and prospects (no buying a tablet and then searching the app store). The mobile share of Web traffic is only going to increase. And the hoped-for convergence of operating systems and devices is not going to come nearly fast enough.

Bottom line: more firms are simply going to have to bite the bullet here and implement an effective mobile site.