Alternative Products and the Importance of a Hook

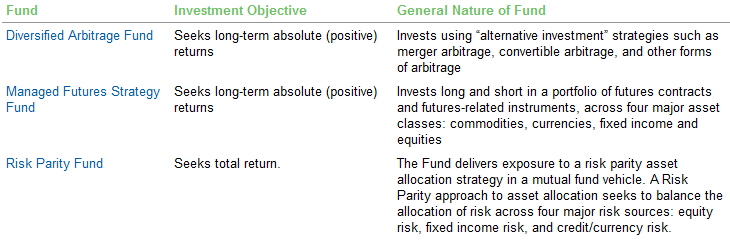

Take a look at the overview of alternative funds from AQR:

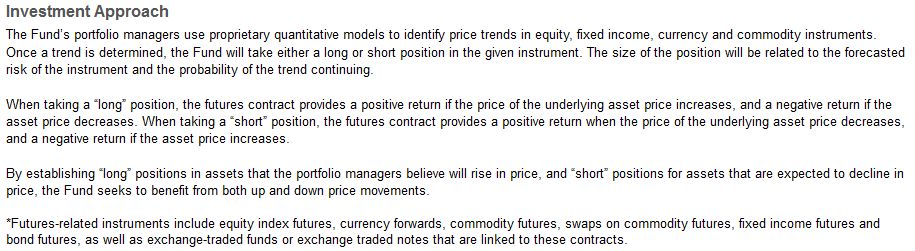

Then, go one step further and look at the initial presentation of the investment approach for the Managed Futures Strategy Fund:

We all know marketing alternative vehicles is difficult. The diversity of strategies, and the still-limited knowledge of many advisors and investors will continue to be significant roadblocks.

But the AQR example also highlights an important issue: initial presentations of alternative vehicles often lack a hook. There is no element that specifically calls out why I should delve into the complexities of this fund.

I don’t really watch a lot of cooking shows, but I’ve seen enough to know that the show almost always begins with a preview of the fully-prepared dish. That’s the hook. That’s why you’ll stick around for 30 minutes and invest your time in the details of the ingredients and process.

People’s lack of familiarity with alts means they’ll need to invest extra time to understand them. This reality gives elevated importance to the initial hook, and alternative providers need to focus more on putting their best foot forward.