Best Blogs of the Week

From last week’s blogs, I gleaned very interesting posts in different areas of asset management

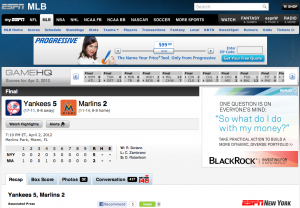

BlackRock – In this post, Sue continues the walk-through of her FA search. I think understanding her process can be exceptionally helpful to any FA looking to increase their client base.

Russell – This post walks through investing with respect to political change. I feel like I’ve already read too many posts about the upcoming election and dramatic impact everyone should expect. Natalie does an excellent job of calming the waters and maintaining a longer time horizon.