Posted by Anu Heda

on Feb 20, 2017,

in

Thoughts

, tagged with

BlackRock,

SSGA,

Vanguard,

WisdomTree

In January, Ignites published a piece titled “AQR Second to Vanguard in Active Flows” (subscription required). The primary points orbit active fund flows. What caught my eye was a link to 2016 passive and active fund flows from Morningstar. From their data, only 6% of passive ETF fund flows ($31.5B) went to issuers outside the top five (Vanguard, BlackRock, SSgA, Fidelity, and DFA). That means 120 ETF issuers split $31.5B (issuer list via etfdb). Seems like a massive issuer group sharing a small slice of the ETF flow pie. What types of products do these issuers provide?

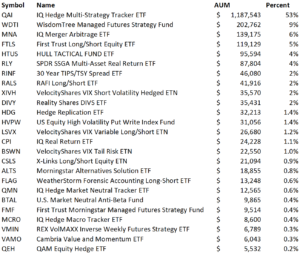

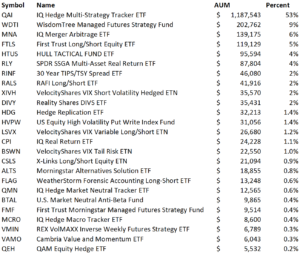

To learn more, I sifted through issuer lists and AUM data. Many of the issuers offer leveraged or inverse ETFs (Direxion, ProFunds) while others have thematic ETFs (GlobalX, VelocityShares). To focus my research, I searched for ETFs with investment strategies classified as “alternatives.” Here’s a list of the top 25 alternatives ETFs (image to the right). Only one comes from BlackRock, SSgA, or Vanguard (it’s from SSgA). To support alternative products, issuers need to educate prospective buyers. That’s basic communication strategy.  So, I studied the Web sites of the four firms with the 5 largest alternative ETFs: 2 from IndexIQ (now part of New York Life by way of MainStay), WisdomTree, First Trust, and Hull Capital. None of them highlight education on their homepages or product profiles. Rather, they model their sites off of traditional active managers with promotions of thought leadership (2017 Outlook, anyone?), product, and firm.

So, I studied the Web sites of the four firms with the 5 largest alternative ETFs: 2 from IndexIQ (now part of New York Life by way of MainStay), WisdomTree, First Trust, and Hull Capital. None of them highlight education on their homepages or product profiles. Rather, they model their sites off of traditional active managers with promotions of thought leadership (2017 Outlook, anyone?), product, and firm.

I think that’s a massive mistake. Focus on education by answering: what’s an alternative ETF? why should you care? how does it precisely fit into an asset allocation plan?